It feels like the cost of everything is going up these days. That’s because inflation has remained higher than usual for longer than expected, driving up prices on goods, services, and just about everything else. With rising expenses all around, you might be wondering—does it even make sense to buy a home right now?

Here’s some good news: owning a home is actually one of the smartest ways to shield yourself from the effects of inflation.

A Fixed Mortgage Keeps Your Housing Costs Steady

One of the biggest perks of homeownership is stability—especially when you lock in a fixed-rate mortgage. Your monthly mortgage payment, which is often your largest expense, stays consistent over time. While property taxes and insurance costs may fluctuate slightly, your principal and interest payments won’t change, no matter how much inflation rises.

The same can’t be said for renting. Rents tend to increase over time—and often at a rate that outpaces inflation. Just take a look at data from the Bureau of Economic Analysis (BEA) and the Census Bureau (see graph below):

While renters face rising costs year after year, homeowners with a fixed-rate mortgage enjoy predictable payments, making budgeting much easier in the long run.

Home Prices Often Outpace Inflation

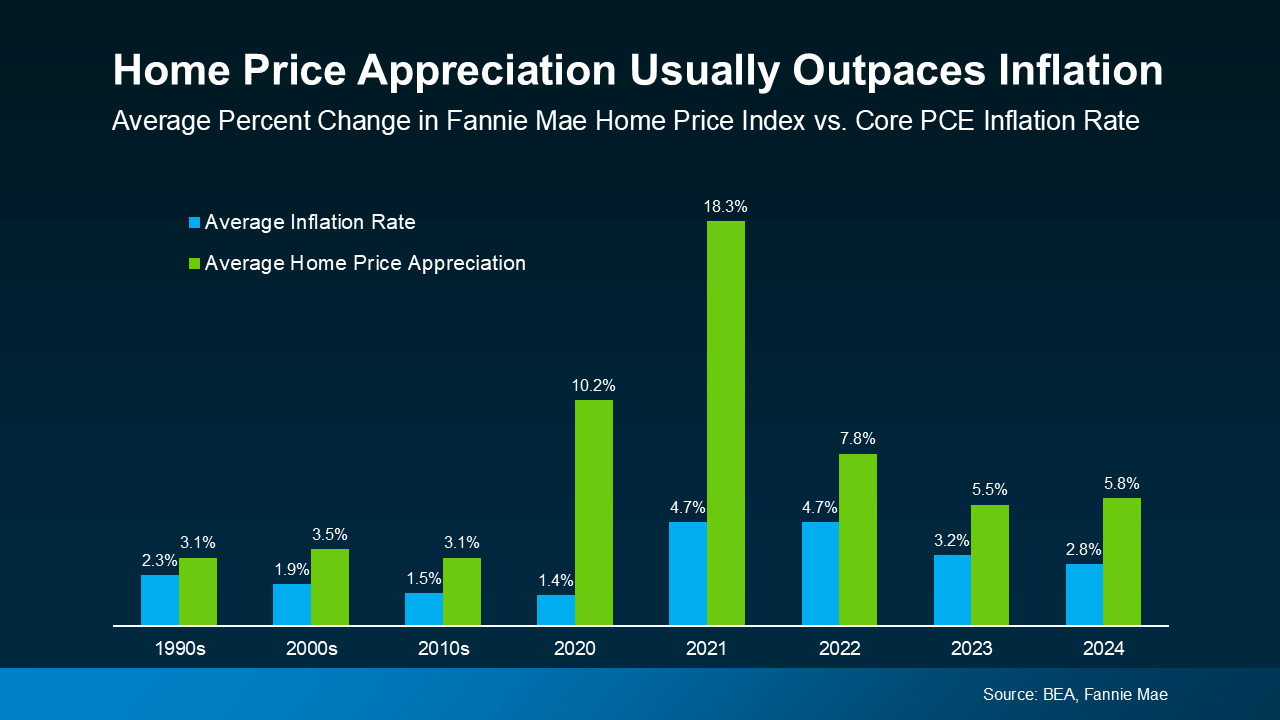

Another reason buying a home is a smart move during inflationary periods? Property values tend to appreciate over time—often at a rate higher than inflation, according to data from the BEA and Fannie Mae (see graph below):

That makes real estate one of the most reliable long-term investments. Unlike cash, which loses value as inflation rises, real estate tends to hold or even grow in value, helping homeowners build wealth.

Meanwhile, renting offers no such advantage. In fact, the opposite is true—when inflation pushes costs higher, landlords typically pass those increases onto tenants through rent hikes.

As a renter, you end up paying more over time without any financial gain. But as a homeowner, rising home prices work in your favor by increasing your home’s value and boosting your equity.

And with experts projecting continued home price growth, buying now means securing an investment that is likely to appreciate and outperform inflation in the years ahead.

The Bottom Line

Inflation may be driving up everyday costs, but homeownership provides financial stability. Unlike renting, where prices continue to rise, a fixed mortgage keeps your monthly payment predictable. And while inflation erodes the value of cash, home values tend to increase, helping you build long-term wealth.

So, how would locking in a fixed housing payment change the way you plan for your future?