Is Renting Holding You Back? Why 2025 Might Be the Year to Buy a Home

If you’ve been stuck between continuing to rent or taking the plunge into homeownership, you’re not alone. Buying a home is a major decision, and renting can feel like the simpler route—no maintenance worries, no long-term commitment. But is it really the best choice for your future?

A recent report from Bank of America reveals that 70% of prospective homebuyers worry about the long-term effects of renting—especially missing out on building equity and dealing with ever-increasing rents.

Sound familiar? Maybe you’re also questioning where renting will leave you down the line. The good news? If the numbers make sense, owning a home can be a smart financial move with long-term benefits that renting just can’t offer.

Let’s break it down.

Homeownership: A Powerful Wealth-Building Tool

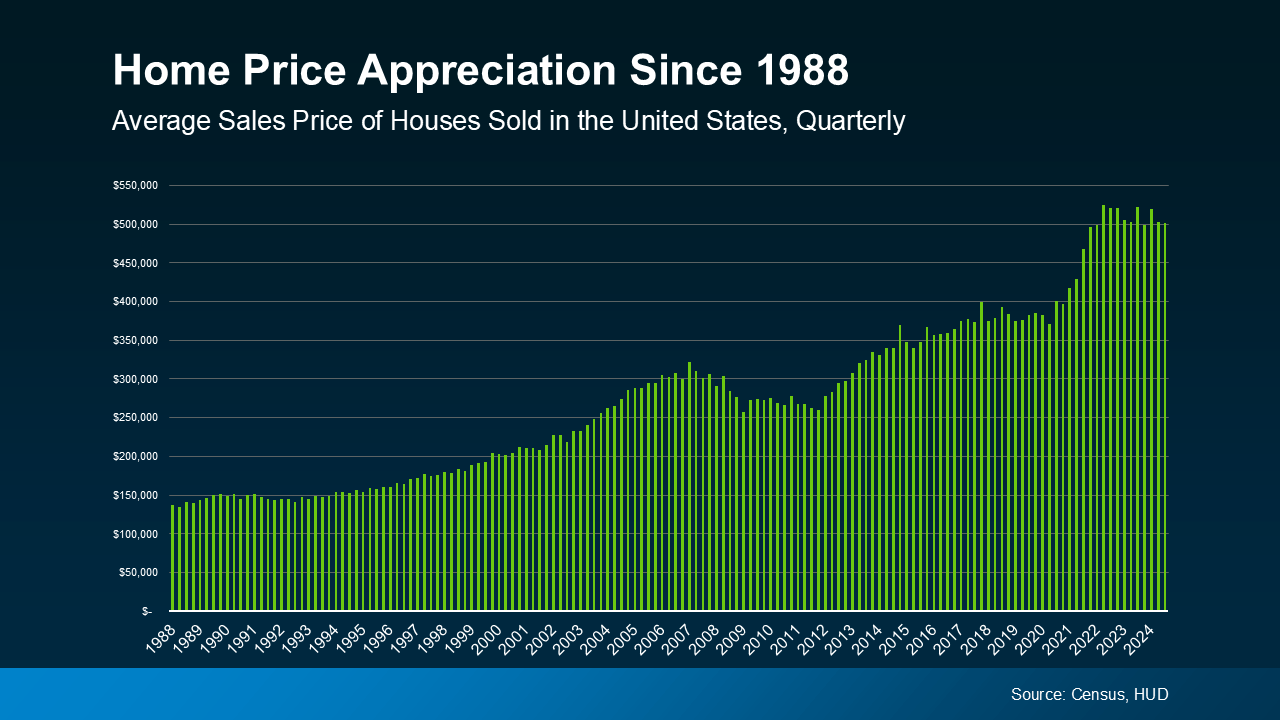

When you buy a home, you’re not just covering a place to live—you’re making an investment. Historically, home values appreciate over time, according to data from the Census Bureau and the Department of Housing and Urban Development (HUD).

What does that mean for you? As your home’s value rises and you pay down your mortgage, you build equity—your financial stake in your home. That equity boosts your net worth and can be a valuable asset down the road.

It’s no wonder that 79% of homebuyers, as surveyed by the National Association of Realtors (NAR), consider homeownership a strong financial investment.

The Cost of Renting: Rising Expenses, No Equity

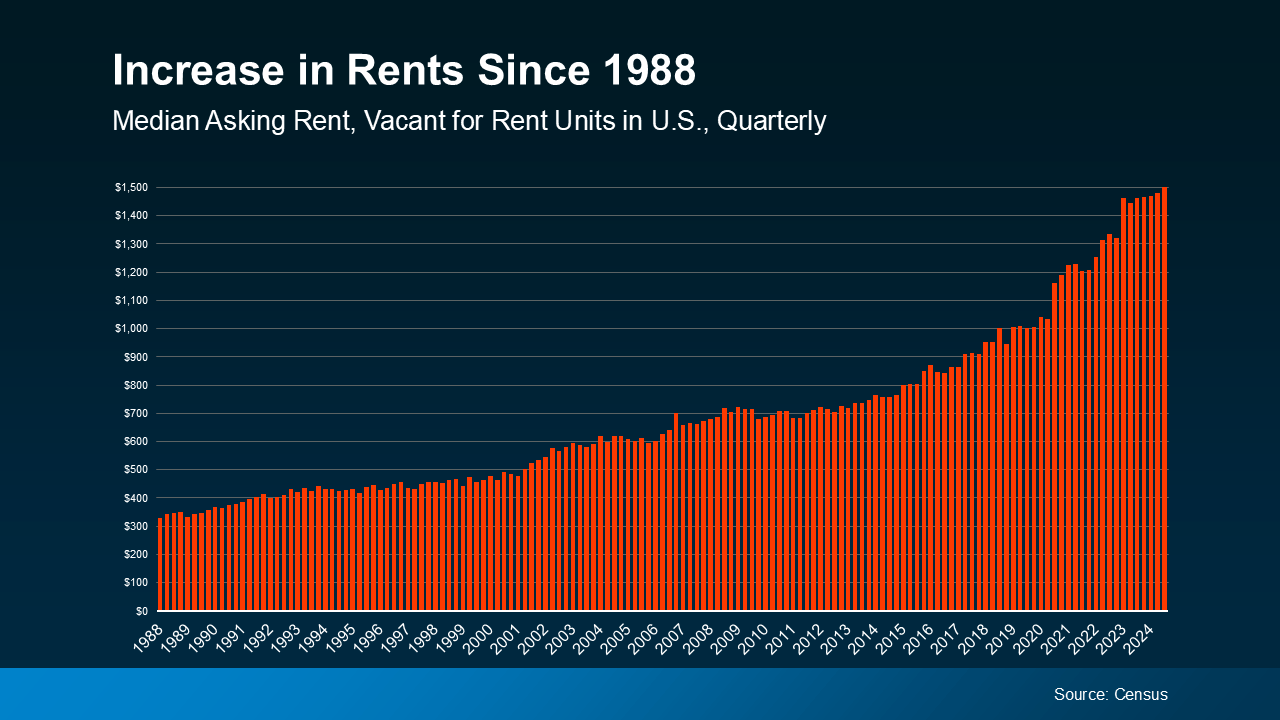

Sure, renting can feel more affordable in the short term, especially in today’s market with elevated home prices and mortgage rates. But over time, renting almost always gets more expensive.

Census data shows that rents have consistently climbed over the decades. Each lease renewal or new rental agreement often comes with a higher price tag—without the benefit of wealth-building.

Think of it this way: every rent check you write helps your landlord build equity, not you. And as rents rise, it becomes even harder to save for a down payment in the future.

Renting vs. Buying: The Bigger Picture

The long-term financial impact is clear—owning a home means your housing costs contribute to your personal wealth, while renting means your money is spent with no return.

Of course, renting has its place. If you’re not in a position to buy just yet, it provides flexibility. But if homeownership is within reach, making the move now can set you up for financial stability in the future.

The Bottom Line

If you’re financially ready, owning a home can be a game-changer for your long-term wealth. Instead of paying into a rental with no return, you can start building equity and securing your future.

Thinking about making the switch from renting to owning? Let’s talk about your options and see if homeownership makes sense for you in 2025.