If you've been holding off on selling your house because you're worried no one’s buying, consider this your sign that the market is heating up again. After months of high mortgage rates keeping buyers at bay, things are starting to look a lot more promising. Rates are finally dropping thanks to some key economic changes, and just yesterday, the Federal Reserve cut the Federal Funds Rate for the first time since they started raising it back in March 2022. Now, while the Fed doesn’t directly control mortgage rates, this move sets the stage for them to fall even more—and guess what? More rate cuts are on the horizon.

This dip in mortgage rates is already drawing more buyers back into the game. Lisa Sturtevant, Chief Economist at Bright MLS, says:

“A drop in the cost of borrowing will help fuel more homebuyer demand . . . Falling rates will also bring more sellers into the market.”

So, if you've been wondering when the right time to sell is, this shift in buyer demand could work in your favor. It’s time to take advantage of this!

As Rates Fall, Buyer Activity Goes Up

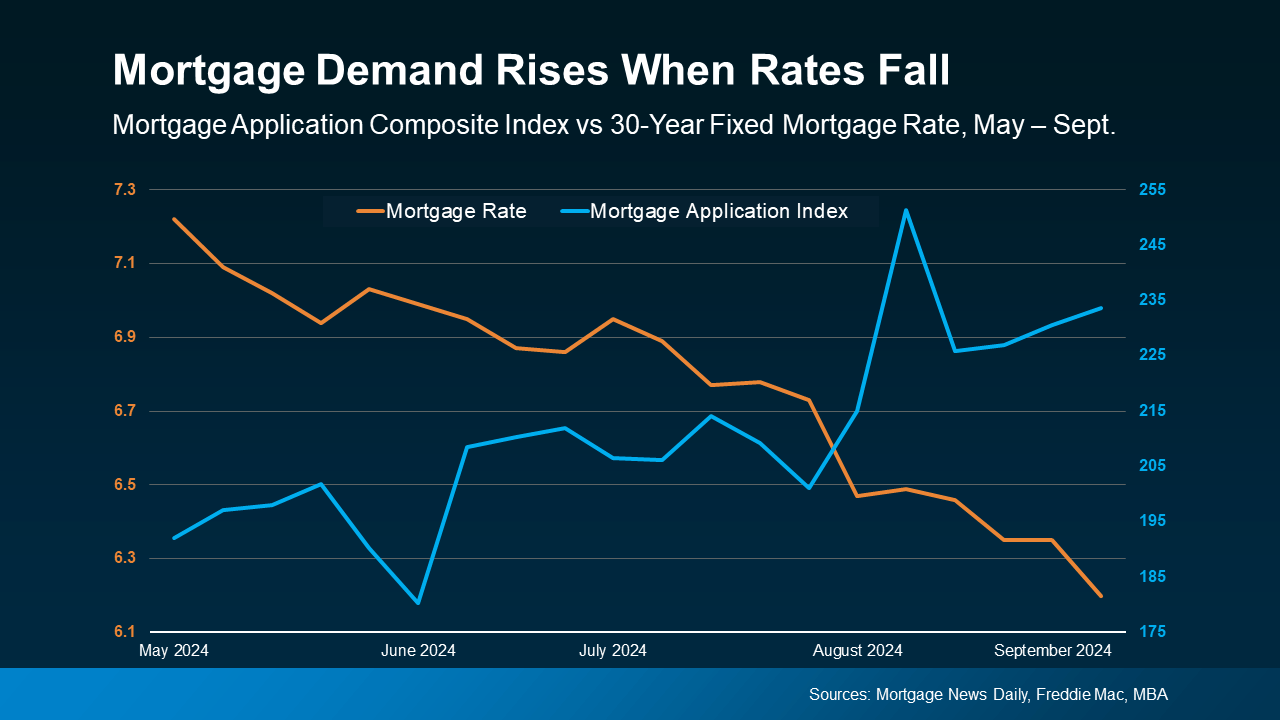

Let’s break it down: When mortgage rates fall, buyer activity starts to climb. The graph below (which I’ll insert for you) will show you exactly how this works. The orange line shows the average 30-year fixed mortgage rate, and the blue line is the Mortgage Bankers Association (MBA) Mortgage Application Index, which tracks how many people are applying for home loans.

As mortgage rates (orange) come down, more people (blue) start putting in mortgage applications, showing renewed interest in the market.

What This Means for You

According to the National Association of Realtors (NAR), home sales were up in July—a refreshing change after four months of decline. If you're a homeowner thinking about selling, this surge in buyer activity is great news for you.

More buyers in the market means more competition for your home, which could lead to higher offers and faster sales. Edward Seiler, AVP of Housing Economics at the Mortgage Bankers Association (MBA), adds:

“MBA is expecting that slower home-price appreciation, coupled with lower rates, will ease affordability constraints and lead to increased activity in the housing market.”

That’s even more reason to feel confident that buyers are back in business and looking for homes like yours.

With more folks entering the market, now's the perfect time to get your home ready to list.

Bottom Line

The drop in mortgage rates is already bringing buyers back into the market, and experts predict this trend will continue. Let’s connect and get your house ready to sell while buyer demand is on the rise. You don’t want to miss out on this wave of interest!